Money 101 by step

The topic of money can seem huge and overwhelming. It doesn't help that most of us enter college without being provided any financial literacy courses in high school. Actually, only 35 states require schools to teach some level of financial literacy. That's why Step has developed Money 101, a financial literacy curriculum that works to fill the gap and help you take the first step towards feeling financially literate and independent.

Step is on a mission to improve the financial future of the next generation, and that starts with you.

To Get Started:

1. Click Get Started

2. Login with your email

3. Update your profile with your school

Step is on a mission to improve the financial future of the next generation, and that starts with you.

To Get Started:

1. Click Get Started

2. Login with your email

3. Update your profile with your school

banking basics

Understanding the banking system, types of services, and accounts available to you so you can make an informed decisions on where and how to manage your money.

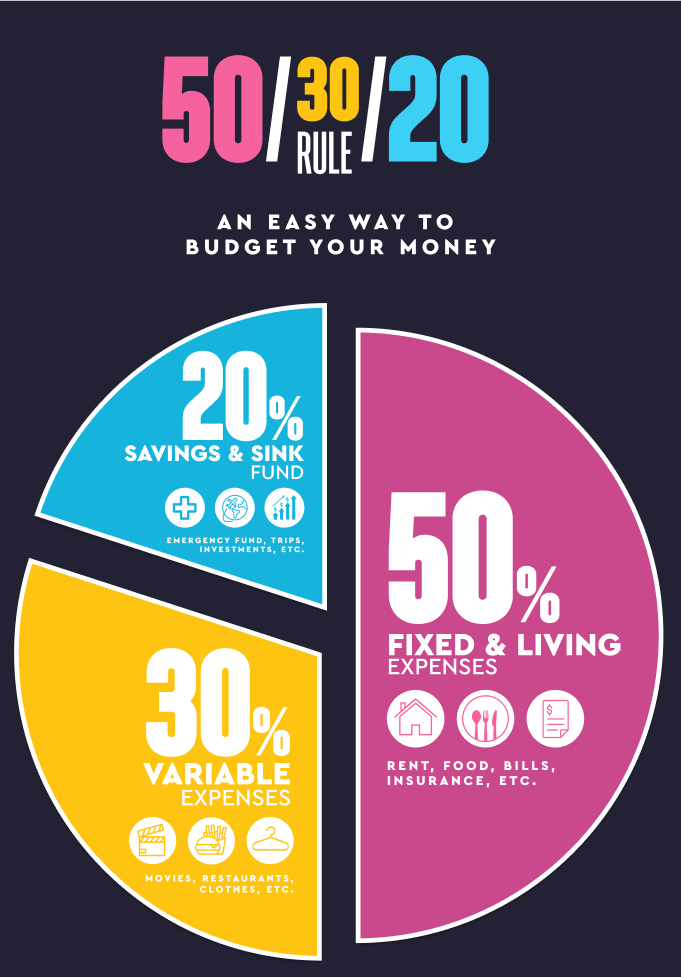

Budgeting & Saving

How to split up and set aside your income - big or small - so you can reach your financial goals, and afford those dream purchases without getting yourself into financial trouble. This includes, budgeting for college and understanding the true cost of tuition and expenses.

Paying for college, Student loans and Credit

Discussing the importance of a credit score, how to build positive credit, and how to borrow money responsibly. Plus, practical skills to prepare you for your first auto or student loan and how to repay them responsibly.

Investing: Stocks & crypto

An introduction to making the most of your money and growing your wealth - from the markets to the metaverse.

Frequently asked questions

Who can enroll in the course?

Currently, Money 101 is available for all! The curriculum is focused on providing financial education for college students, but is accessible to everyone that wants to improve their financial future.

do I need a step account to enroll?

No, a Step Account is not required to participate but recommended to help users apply the lesson in a real world environment and to responsibly build credit.

is it free?

Yes! Financial literacy should never cost you a penny!